President Eisenhower’s Civil Rights Act, Dr. Seuss’ The Cat in the Hat, and the launch of Sputnik by the Soviet Union were respectively important social, cultural, and technical news stories of 1957. There is one event that year did not make headlines but over the next 60 years also profoundly impacted all three aspects of modern society.

On September 19, 1957, eight scientists and engineers defected from their employer to sign papers establishing their own company. Their startup, Fairchild Semiconductor Corporation, went on to develop some of the most important innovations in 20th century electronics technology and sowed seeds that spawned Silicon Valley and changed the world.

A symbolic contract signed by the Fairchild founders and bankers on September 19, 1957.

With funding from Southern California industrialist Arnold Beckman, William Shockley, co-inventor of the transistor at Bell Telephone Laboratories established his Shockley Semiconductor Laboratory in Mountain View, California, in 1955. He attracted a group of bright young engineers and scientists that he trained in the art of working with silicon semiconductor material. Although a brilliant physicist—he shared the 1956 Nobel Prize in Physics for his contributions to the transistor—Shockley’s staff quickly became disenchanted with his paranoid and abrasive management style. After unsuccessfully petitioning Beckman to appoint a new manager, eight of Shockley’s most talented employees—Julius Blank, Victor Grinich, Jean Hoerni, Eugene Kleiner, Jay Last, Gordon Moore, Robert Noyce, and Sheldon Roberts—sought alternative employment. Assisted by Arthur Rock, who later formed one of the first West Coast venture capital firms, the eight men raised $1.38 million from East Coast−based Fairchild Camera & Instrument Corporation. Their timing was impeccable. With the national urgency to recoup the loss of leadership to the Soviet Union, military contractors engaged in crash programs to miniaturize and improve the reliability of aerospace electronic systems. Fairchild founders identified an opportunity for a new kind of silicon transistor to serve these applications.

The Fairchild founders in 1961. Rear row from left: Victor Grinich, Gordon Moore, Julius Blank, Eugene Kleiner. Front row: Jay Last, Jean Hoerni, Sheldon Roberts, and Robert Noyce. Photo © Wayne Miller/Magnum Photos

In just five months they outfitted an R&D facility in Palo Alto, developed new processes and equipment, and introduced a line of transistors that found instant acceptance in the market. Fairchild’s rapid growth in revenue, number of employees, and impact on the local community can be compared to that of Google 40 years later. This extraordinary level of success was built on revolutionary insights by three co-founders—Jean Hoerni, Robert Noyce, and Gordon Moore and amplified by an “Innovation Machine” staffed by hundreds of creative engineers and scientists.

In 1959 co-founder Jean Hoerni invented a transistor structure covered with an insulating layer of silicon dioxide (glass) to protect the chip. Known for their flat surface profile as “planar” devices, they were more reliable and offered superior electrical characteristics to competing products. By the end of 1961, their success vaulted Fairchild to the largest producer of high-performance silicon transistors in the United States.1

“Teardrop” design of the first planar transistor, 1959.

Hoerni’s approach also enabled the transformation of semiconductor production from a handcrafted process to a high-volume operation amenable to automation. His breakthrough idea continues as the fundamental structure employed in the manufacturing of today’s multibillion-transistor microprocessor and memory chips. Historian Christophe Lécuyer describes it as “the most important innovation in the history of the semiconductor industry.”2

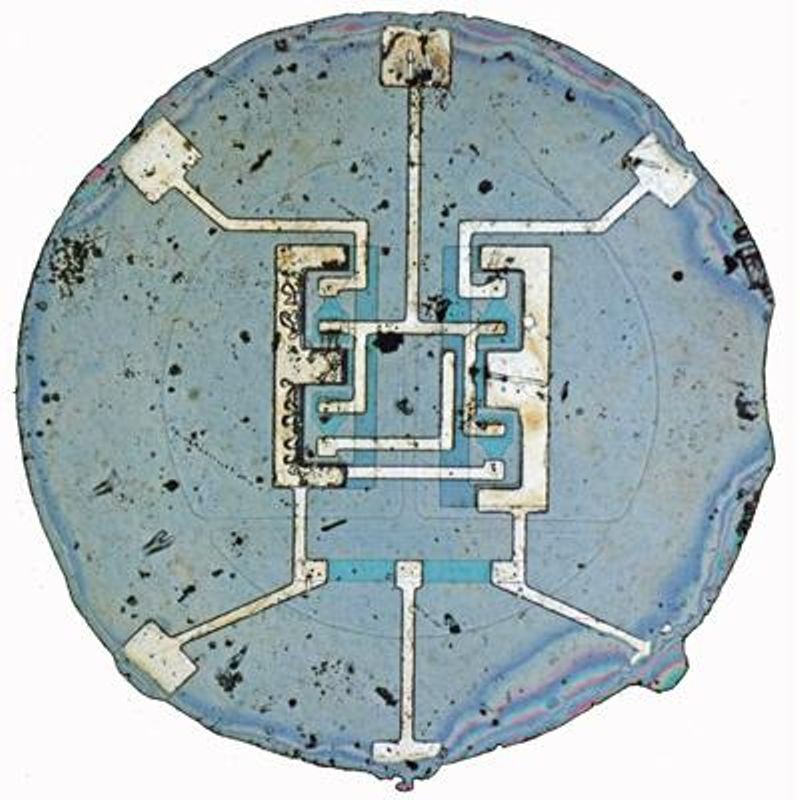

Fairchild co-founder Robert Noyce conceived the idea of using aluminum metal deposited on top of Hoerni’s layer of glass to selectively interconnect transistors, resistors, and other components formed in the underlying silicon wafer to create an integrated electronic circuit (IC). Fairchild introduced its first IC, or microchip, a digital logic function comprising just four transistors and five resistors in March 1961.

Fairchild’s first integrated circuit had four transistors, 1960.

As the Fairchild IC design embodied some elements of a patent awarded to Jack Kilby of TI, the companies engaged in litigation for many years. The Supreme Court eventually ruled in Fairchild’s favor but Kilby and Noyce both received the National Medal of Science and today are celebrated as co-inventors of the IC. Noyce died in 1990 and did not enjoy the Nobel Prize awarded to Kilby in 2000, but many believe that had he lived they would have shared the prize. NASA selected the Fairchild chip for the Apollo Guidance Computer that became the world’s largest user of ICs through 1965.3 All major manufacturers licensed the Fairchild planar process for mainstream semiconductor production.

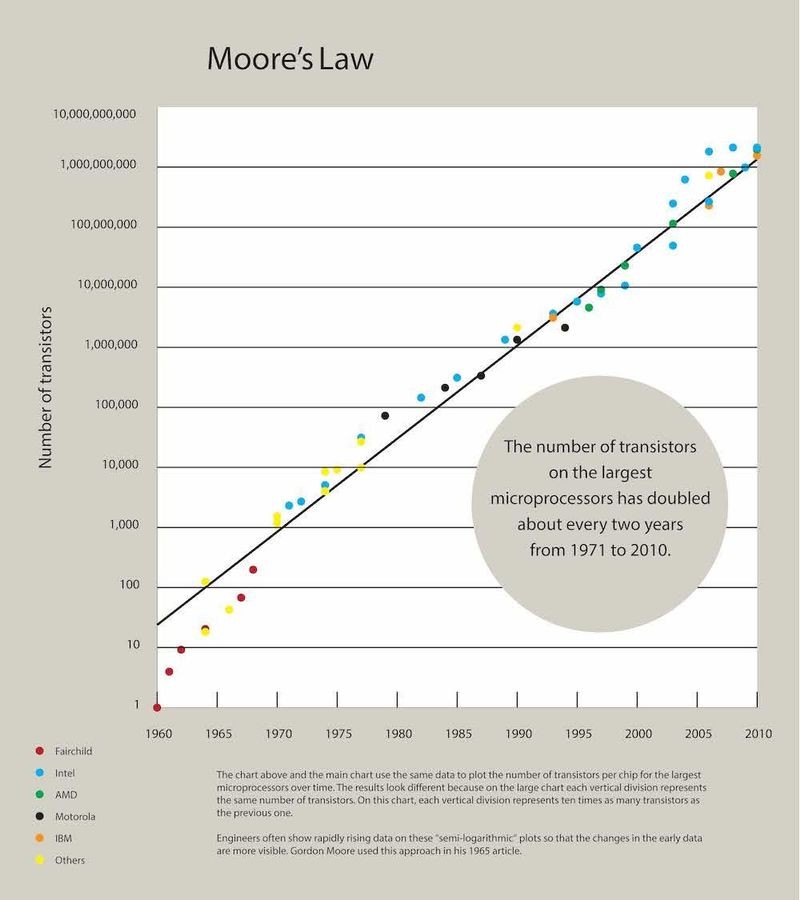

In 1965 Director of R&D Gordon Moore wrote an article for Electronics magazine that described a doubling in each of the prior four years in the number of transistors that could be fabricated economically on a chip. If this rate continued, he projected that the number of transistors per chip would reach 65,000 in 1975.4 In 1975 Moore, by then president and CEO of Intel, noted that advances in technology had allowed his projection to be realized. On reviewing then current trends he slowed the future rate of increase in complexity to “a doubling every two years, rather than every year.” This prediction became known as “Moore's Law” and emerged as a self-fulfilling prophecy and one of the driving principles of the semiconductor industry.

Moore’s “Law” plot of the number of transistors per chip for the largest microprocessors introduced each year from 1971 to 2010.

As semiconductor device sizes approach atomic dimensions, technologists predict the demise of the “Law.” As of 2017, however, chips containing 30 billion transistors continue to comply with Moore’s 1975 prediction.5

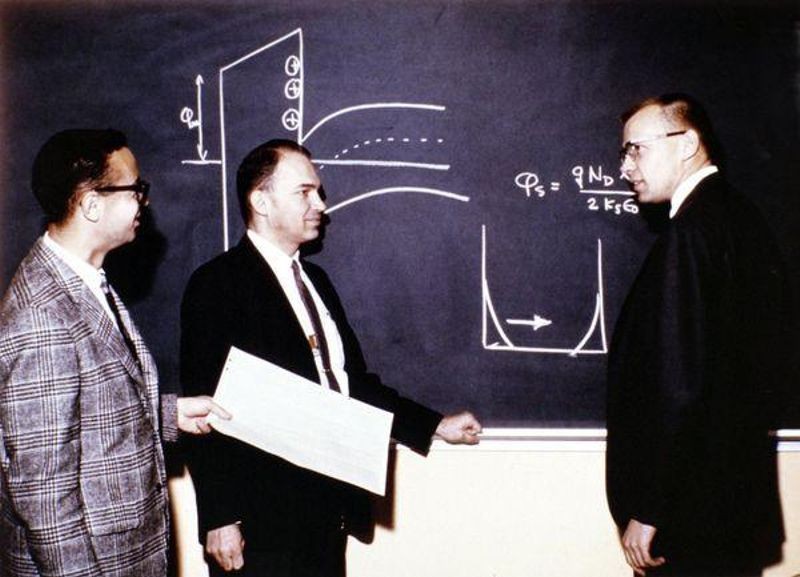

Through the decade of the 1960s, the company continued to innovate in other important areas of semiconductor technology. Fairchild scientists, led by Bruce Deal, Andy Grove, and Ed Snow, pioneered reliable metal oxide semiconductor (MOS) production. Federico Faggin and Tom Klien built the first commercial silicon-gate devices. Frank Wanlass patented complementary MOS (CMOS). All three are fundamental to mainstream chip manufacturing today.

Andy Grove, Bruce Deal, and Ed Snow discuss MOS technology at the Fairchild Palo Alto R&D Laboratory, 1966.

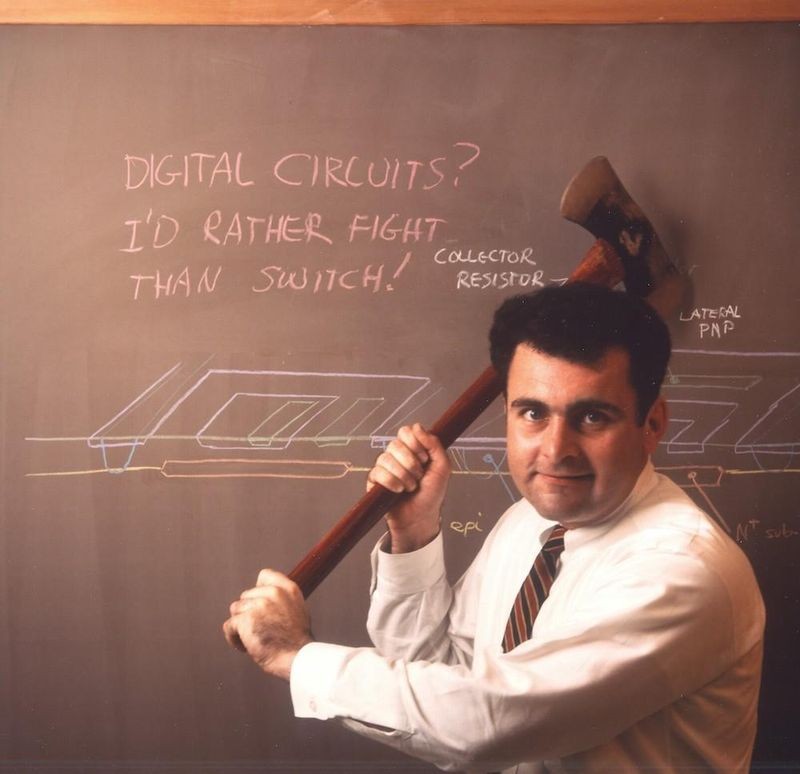

Many vendors developed integrated versions of simple analog circuits as early as 1962 but they achieved limited market acceptance. Recently out of college, colorful young designer Robert Widlar worked with process engineer Dave Talbert to conceive the first widely-used analog IC, the Fairchild µA709 operational amplifier (op-amp) in 1965 and established a mass market for analog devices and a highly profitable business unit for Fairchild. David Fullagar’s improved version, the µA741, remains in production today as the most popular analog IC of all time.6 Fairchild alumni started many important analog IC companies including Linear Technology and Maxim.

Analog guru Robert Widlar defends against the digital invasion, 1966. Photo © Fran Hoffart.

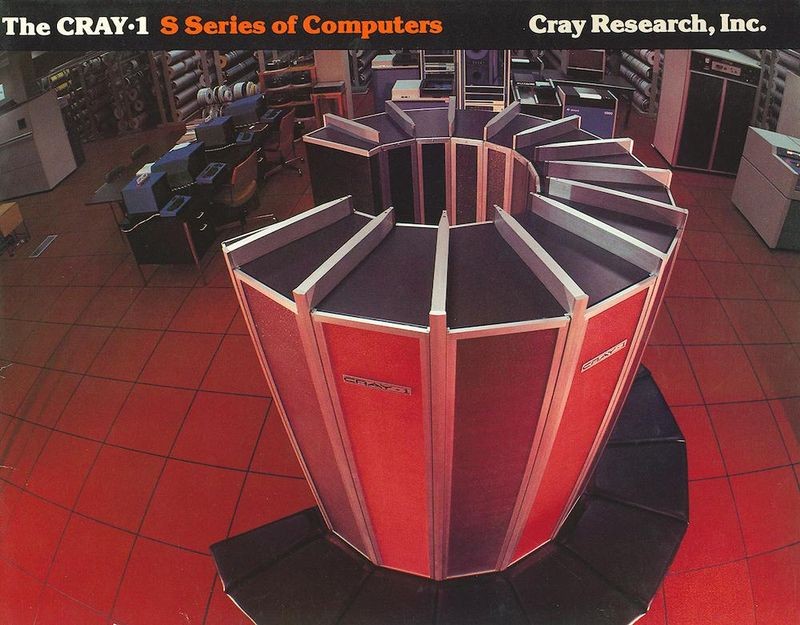

As ICs began to incorporate thousands of transistors, the computers they enabled were harnessed to speed the development cycle and eliminate design errors. Jim Koford worked on early computer aided design programs at IBM. He joined Fairchild in 1966, where he led Hugh Mays, Ed Jones, Rob Walker, and others to apply them to ICs. They designed graphic displays, logic simulators, and place and route software for chip interconnect patterns. Their efforts laid the ground work for generations of electronic design automation (EDA) tools and the beginnings of an independent EDA industry in Silicon Valley as well as custom IC vendors such as LSI Logic and VLSI Technology. Robert Norman filed an early patent for using IC flip-flop chips in a semiconductor RAM array but Gordon Moore “decided it was so economically ridiculous, it didn’t make any sense.”7 By 1963 Moore changed his opinion and described the possibility of semiconductor memory as “especially inviting.” Although Fairchild established a Memory Products business unit it was never able to leverage pioneering efforts in MOS semiconductor memory into the significant market position achieved by its most important spin-off Intel Corporation. It did become a dominant player in specialty high-speed memory devices in the 1970s for supercomputer companies such as Burroughs and Cray.

The Cray 1 supercomputer used 65,000 Fairchild high-speed RAM chips for main memory.

Numerous other pioneering contributions included improved power transistors, light emitting diodes (LED), imaging sensors, and chip packaging techniques.

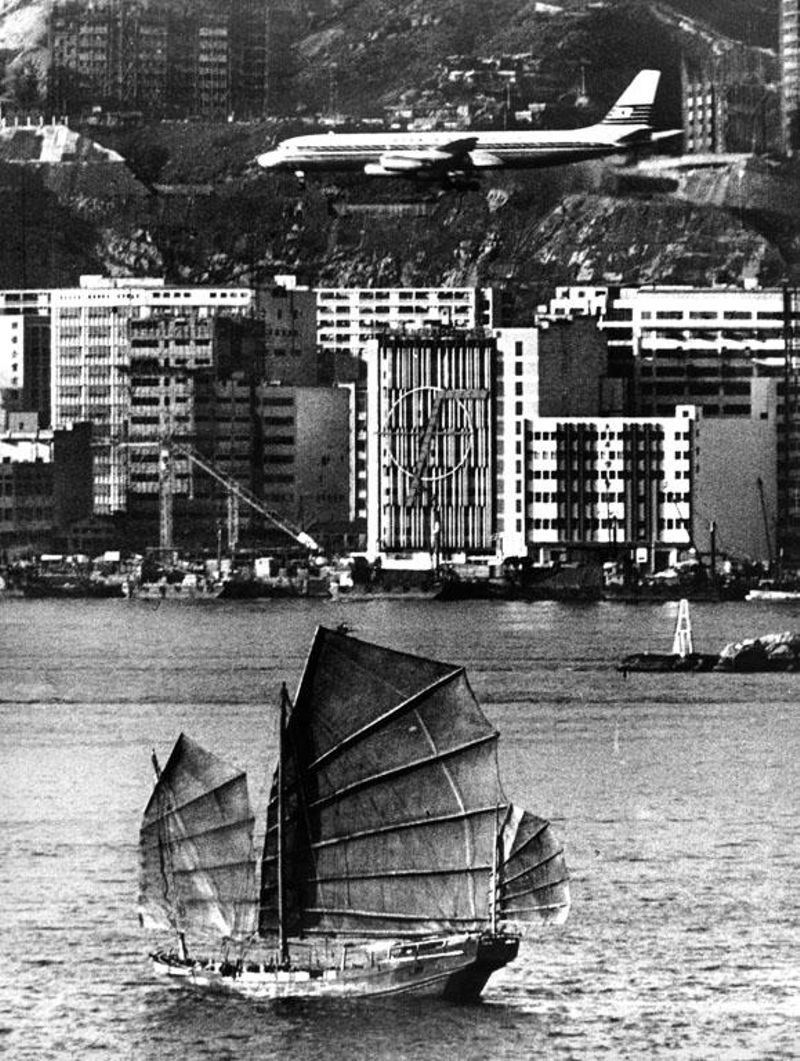

Fairchild opened its first plant outside the Bay Area in South Portland, Maine, in 1962. As one of the first US technology companies to expand into Asia, C. E. (Ed) Pausa led the construction of a factory in Hong Kong in 1964. Two years later Hong Kong employed 5,000 workers versus 3,000 in California. The success of this venture attracted other component companies and began the high-tech industry move to major offshore manufacturing operations.

Fairchild Hong Kong plant with the “Flying F” logo (1965)

Fairchild marketing mavens including such luminaries as Don Valentine (who later moved to National Semiconductor and Sequoia Capital), W. J. Sanders III (AMD), and Floyd Kvamme (National Semiconductor, Apple Computer) initiated practices that are now taken for granted in marketing of high technology products world-wide. Creative promotional approaches aided the sales force in telling the Fairchild story to engineering decision makers.

To reach the broadest possible audience on October 10, 1967, the company purchased air time on 32 TV stations that broadcast to the major centers of electronic systems design across the country. Fairchild’s Harry Sello presented a half hour “Briefing on Integrated Circuits” in what is claimed to be one of the first television infomercials. Bold and extravagant use of the latest communications medium to promote high-tech products is common today. In the 1960s it was unique and controversial. Faust/Day a new Southern Californian agency developed aggressive advertising programs. According to public relations manger Elliott Sopkin, “No one had tried to sell technology like soap before.” The agency merged into Chiat/Day in 1968 and went on to produce distinctive work for Apple Computer, including the Macintosh “1984″ Super Bowl commercial.

According to journalist Michael Malone, “Fairchild Semiconductor was a company of legend – perhaps the most extraordinary collection of business talent ever assembled in a startup company. If Fairchild had a corporate culture it could only be described as volatility incarnate... brilliant young engineers and marketers working long days, and partying long nights... And somehow in the middle of it all, they also managed to invent the integrated circuit, the defining product of the late 20th century, and in the process helped to create the modern world.”8

The management style that emerged from this culture differed from the straight-laced, bureaucratic, almost feudal ethos of the East Coast parent. Youth, inexperience, testosterone, passion, a diverse mix of immigrants from across Europe and Asia, a tolerance for risk-taking, and a strong engineering discipline evolved into a formula that was replicated across the Valley as employees spun-out to successor companies such as AMD, Intel, and National Semiconductor and on to Apple, Atari, Netscape and Sun and thence to Cisco, Google, Facebook and beyond.

The financial rewards enjoyed by the Fairchild eight did not go unnoticed by later employees who had received only modest stock grants, if any. As the returns available in high-technology investments became more widely apparent, symbiotic relationships between entrepreneurs and bankers blossomed into the venture-capital fraternity lining Sand Hill Road in Menlo Park, California. Fairchild co-founder Eugene Kleiner teamed with Tom Perkins of HP to found their iconic partnership, that thrives today as KCPB. This local availability of capital that understood technology combined with an aggressive, risk-taking culture established Silicon Valley as one of the world’s most vibrant centers of new company formation and high-wage job creation.

C. Lester Hogan, Fairchild CEO and President (1972)

Starved by the parent company for funds for investment in new production facilities, for equity to retain key employees, and torn by internal organizational issues, by the late 1960s the semiconductor division encountered serious problems with introducing new products and satisfying fast growing customer demand. As Gordon Moore explained:

“Fairchild grew to be about a $150 million business and some 30,000 employees by the late sixties. It was a fairly significant corporation by the time we were done. But things began to deteriorate – partly, I think, because it was controlled by an East Coast company... We had also made a tremendous number of mistakes, and we had squandered opportunities along the way. It was excellent on-the-job training, but there probably is a more efficient way of training entrepreneurs than by letting them make all the mistakes. Fortunately, good products make up for a lot of problems in an organization, and I think that was what happened in our case.”9

In October 1967, a industry downturn and loss of IC market share to Texas Instruments resulted in the division losing money for the first time since the start-up phase. After Moore and Noyce left to found Intel and all but one of the founders and many senior employees had left the company, in 1968 a new team of former Motorola executives led by C. Lester Hogan Hogan arrived to turn the company around. The new management continued to innovate in semiconductor technology and products such as CCD imagers but ventures into consumer products, including digital watches and video games, were less successful. Although revenues grew substantially under the new regime, the company never regained its former profitability and prominence.

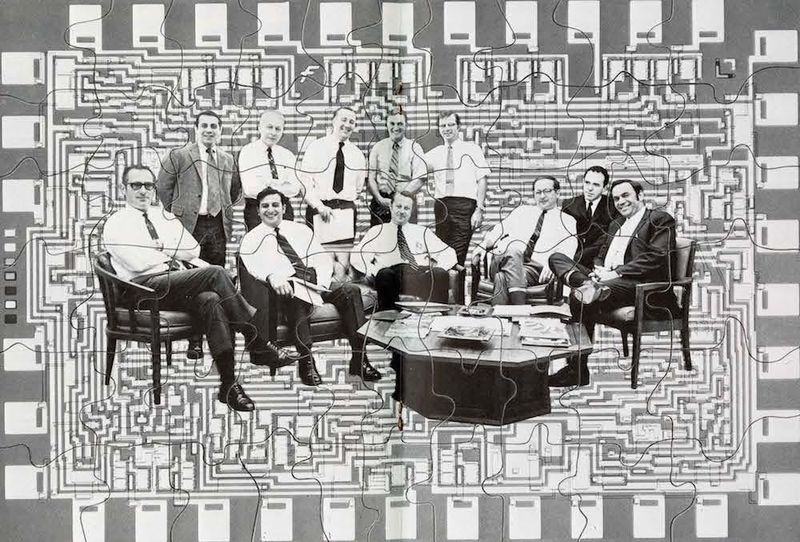

This composite image from Leadwire (April−May 1970) features 11 group directors responsible for leading the Semiconductor Division in 1970. Former Motorola executives indicated were known as “Hogan’s Heroes.” From left to right front row: Jim Hazle, Tom Longo, Joe Van Popplen, George Scalise, Doug O’Connor, Gene Blanchette Rear row: Andy Procassini, Bob Friedman, Wilf Corrigan, Dave Haynes, Bill Lehner

French oilfield services conglomerate Schlumberger purchased the company in 1979. Unable to restore its fortunes, Schlumberger sold the assets to National Semiconductor in 1987. Ten years later National divested a number of mature product lines in a leveraged buy-out to a group of executives based at the South Portland, Maine, facility. Reviving the Fairchild name, the new company grew revenues to more than one billion dollars before being acquired by ON Semiconductor in 2016.

Journalist Don C. Hoefler, who in 1971 popularized the name “Silicon Valley,” published an article in 1968 that traced the lineage of 15 local semiconductor companies to Fairchild. By 1986 a Silicon Valley Genealogy chart based on Hoefler’s research, including such giants as AMD, Intel, and National, had increased the count to 125 spin-outs.10 This did not include hundreds of other tech companies and service business startups. According to industry analyst Endeavor Insight, of the more than 130 San Francisco Bay Area tech companies trading on the NASDAQ or the New York Stock Exchange in 2014, “70 percent of these firms can be traced directly back to the founders and employees of Fairchild. The 92 public companies that can be traced to Fairchild are now worth about $2.1 trillion, which is more than the annual GDP of Canada, India, or Spain.”11 This lineage is presented in The Trillion Dollar Startup a temporary exhibit in the lobby at the Computer History Museum. Developed by the Museum’s Exponential Center, a mural display depicts the company as a giant high-tech tree, laden with a harvest of spin-off companies that span six generations of Silicon Valley technology eras from semiconductors to social media.

The Trillion Dollar Startup, Museum lobby, 2016−2017.

Fairchild was not the first successful Bay Area tech company to have a significant impact outside the region. Nor was it unusual to spin out competing entrepreneurial ventures. Examples of both occurred early in the 20th Century with the founding of wireless communications pioneer Federal Telegraph. Litton, Hewlett Packard, Ampex, and others followed. Fairchild was unique in the magnitude of its contributions to both enabling the digital electronics age and the rise of Silicon Valley.